Venture Capital’s Reset: Why MEI and Market Agility Must Align

The venture market is recovering—but allocator pipelines are not. Our latest analysis shows why Merit • Excellence • Intelligence (MEI) must be the framework guiding the next era of venture capital.

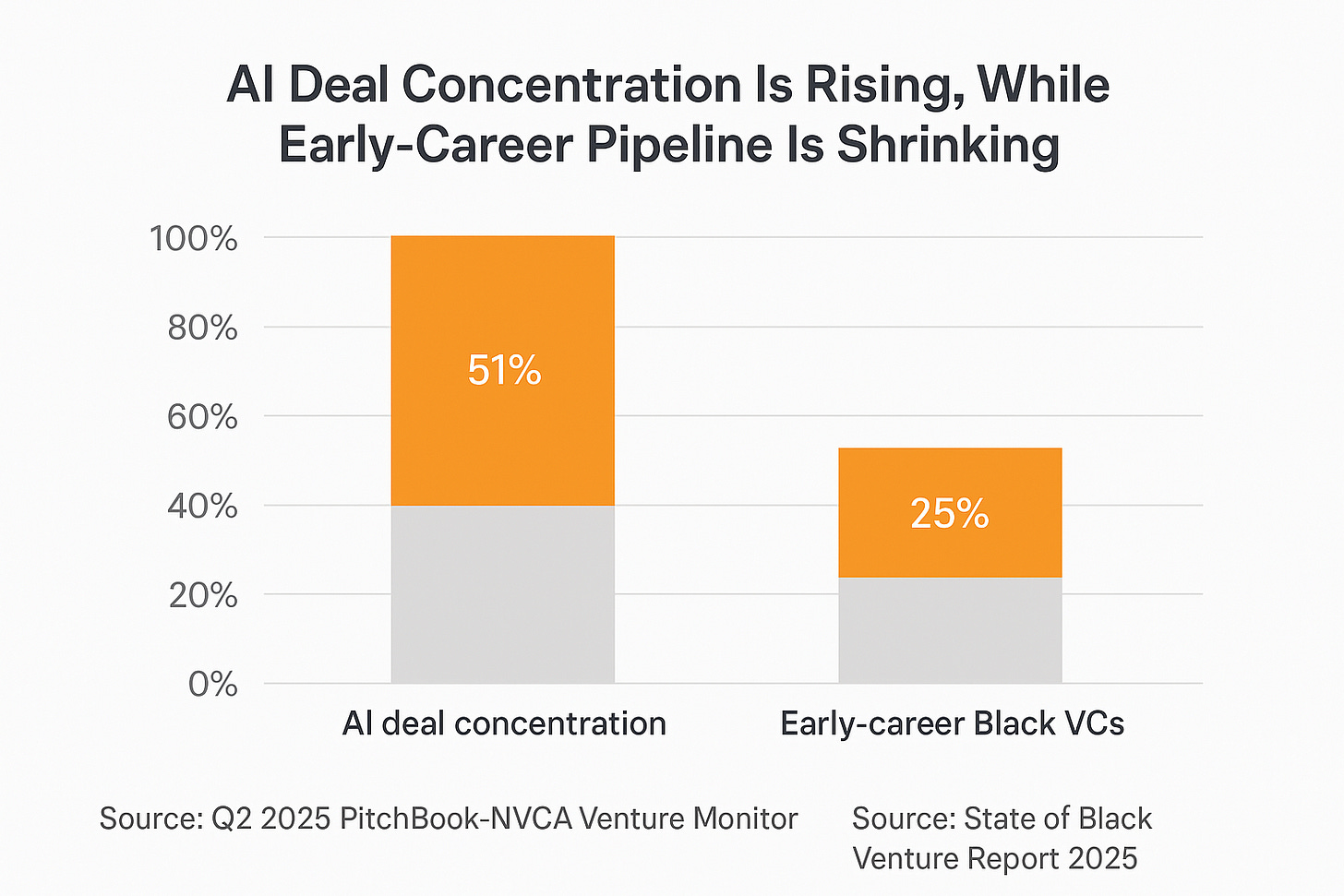

Venture capital is experiencing a paradox. Headline numbers suggest recovery: mega-deals in artificial intelligence, rising valuations across multiple stages, and cautious optimism in IPO markets. Yet beneath this surface-level momentum, the allocator pipeline is shrinking—particularly for early-career professionals who should be the industry’s next generation of leaders.

This duality is more than a passing imbalance. It exposes structural inefficiency in how capital flows and how talent develops. At DVRGNT Ventures, we view this challenge not through the lens of rhetoric, but through the discipline of Merit • Excellence • Intelligence (MEI), combined with a commitment to workforce culture and community strength. Together, these principles form a performance framework for building long-term advantage.

Two Reports, Two Stories

Macro View: NVCA Venture Monitor

The Q2 2025 PitchBook-NVCA Venture Monitor highlights a market concentrated at the top. AI captured over half of venture investment dollars, with five separate AI deals surpassing $1 billion in the first half of the year. Meanwhile, deals under $5 million fell to a decade low, and capital continues to cluster around the Bay Area, New York, Los Angeles, and Boston.

Micro View: State of Black Venture Report

The 2025 State of Black Venture report paints a very different picture. Among 117 Black venture professionals surveyed, only 17% reported a promotion in the past year—down from 28% in the prior cycle. Early-career participation is shrinking, and fewer than one in four respondents see internal advancement as a viable path. Yet within this constrained environment, Black investors are adopting nontraditional capital models and deploying generative AI tools at higher rates than the industry average.

The Disconnect: The market is scaling up, but the talent pool is narrowing. This is not sustainable.

The Structural Risk of a Narrowing Pipeline

Capital is flowing toward fewer, larger, and more geographically concentrated deals. At the same time, the allocator base is aging and losing early-career depth. This narrowing of both capital and talent funnels undermines the adaptability venture capital requires.

Without replenishing the pipeline of skilled allocators from underinvested geographies and diverse professional backgrounds, the industry risks mispricing opportunity, overlooking non-obvious markets, and reinforcing homogeneity in capital deployment.

MEI: A Framework for Structural Advantage

At DVRGNT Ventures, we see MEI as a strategic framework—not a slogan:

Merit: Prioritizing demonstrable capability and execution track records over legacy credentialism.

Excellence: Holding both our firm and our portfolio companies to measurable standards in governance, growth, and operational discipline.

Intelligence: Broadening the definition of intelligence to include geographic fluency, sector expertise, and network-based insights that traditional VC often overlooks.

When combined with workforce culture and community strength, this framework produces more resilient teams, stronger capital allocators, and a broader aperture for opportunity identification.

The Great 38™️: Where MEI Meets Market Opportunity

DVRGNT Ventures applies MEI in The Great 38™️—the 38 U.S. states that contribute significantly to GDP yet remain chronically underinvested in venture. These markets represent overlooked alpha: founders solving real problems at scale, untapped consumer bases, and talent pools undervalued by credential-driven gatekeeping.

We see The Great 38™️ not as a secondary market, but as the primary growth frontier for U.S. venture capital over the next decade.

The Path Forward

The venture industry cannot afford to focus solely on capital deployment metrics while ignoring the talent architecture that sustains it. By embedding MEI and workforce culture into both fund management and investment strategy, LPs and GPs can build durable advantage:

More accurate risk assessment through diverse intelligence sources.

Greater adaptability in volatile macro environments.

Enhanced resilience in both capital flows and organizational culture.

This is not about optics. It is about structural performance.

At DVRGNT Ventures, we invite investors, founders, and policymakers to join us in building an ecosystem defined not by exclusionary cycles, but by durable excellence.

We’d love for you to join the conversation:

For Investors:

What products have you seen gain unexpected momentum because of their cultural cachet, maybe even through a surprising media alignment?

For Founders:

Are you building a product with inherent cachet that's ready to capture the imagination of tastemakers, especially from the Great 38? We want to hear from you.

Apply at the link below to learn more about our founder-first approach.