Rethinking Innovation in the Wake of Urban Population Shifts

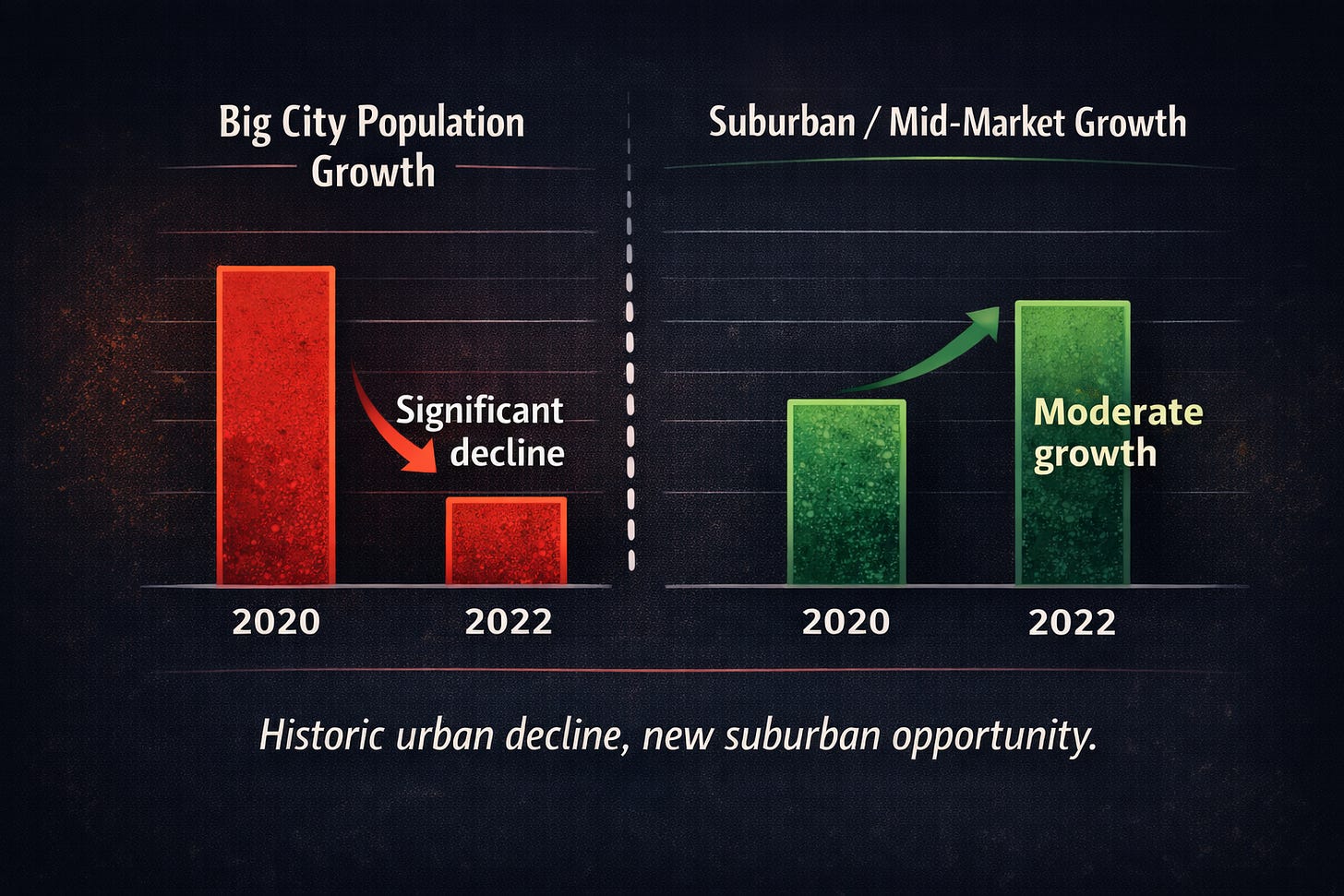

Brookings data shows America’s largest cities lost population at historic levels during the pandemic—yet this decentralization is creating fertile ground for new innovation clusters.

The COVID-19 pandemic has reshaped the geographic footprint of the United States in ways not seen in decades. According to a Brookings Institution analysis, America’s largest cities experienced historic population losses between 2020–2022, while suburban growth also slowed. These shifts are not merely demographic curiosities—they signal fundamental changes in where and how innovation can emerge.

At DVRGNT Ventures, we see this transformation as a catalyst for new investment theses and growth opportunities, particularly across The Great 38™️—the underinvested regions of the U.S. that stand to benefit most from this decentralization.

From Density to Distribution: A New Innovation Map

Historically, major urban centers—New York, San Francisco, Los Angeles, Chicago—have been engines of capital, talent, and technology. The pandemic disrupted this concentration, driving out-migration to smaller cities, regional hubs, and exurbs. While population losses in core metros may appear destabilizing, they also create a distributed innovation landscape that redefines how ecosystems form.

This dispersion of talent and capital presents an opportunity: regional clusters can now emerge as viable innovation centers if they leverage digital infrastructure, specialized workforce development, and targeted capital formation.

Innovation Opportunities in Suburban and Mid-Market Economies

The suburbanization of innovation does not mean simply replicating urban models outside of cities. Instead, it requires designing for the unique needs and growth levers of distributed markets:

Digital-First Service Models

With fewer residents relying on traditional city infrastructure, industries like healthcare, education, and retail must adopt digital-first approaches. Telehealth, online learning platforms, and direct-to-consumer logistics models are poised to thrive.

Next-Generation Logistics

Population shifts strain traditional supply chains. Suburban and mid-market regions are incubating new logistics solutions—from AI-optimized warehousing to drone and autonomous delivery networks—driven by the need for cost-effective distribution at scale.

Housing & Community Infrastructure

Demand for affordable, sustainable housing in secondary markets is rising. This creates white-space opportunities in modular construction, energy-efficient design, and mixed-use developments that serve both residential and innovation-driven workspaces.

Workforce Rebalancing

As knowledge workers relocate, regional economies can capitalize on fresh talent pools. Venture-backed startups in smaller markets can recruit top talent at lower costs, accelerating innovation in places once overlooked by traditional VC.

Implications for Capital Allocation

For investors, the lesson is clear: value creation is no longer confined to coastal metros. The pandemic accelerated a trend toward distributed innovation that aligns with long-term demographic shifts. Capital deployed into these ecosystems is not only catalytic but also strategically advantaged:

Lower competition for deals compared to oversaturated coastal hubs

Favorable valuations and longer runways for startups

Policy alignment with states and municipalities seeking to attract innovation capital

Enhanced resilience as distributed markets diversify systemic risk away from a handful of urban centers

The DVRGNT Ventures Perspective

At DVRGNT Ventures, our thesis has always centered on unlocking the overlooked potential of The Great 38™️. The Brookings data affirms that talent, ambition, and consumer demand are no longer confined to Tier 1 cities. The future of innovation will be distributed, resilient, and deeply rooted in communities that were historically underinvested.

We believe the next decade will not be defined by a single Silicon Valley, but by dozens of regional valleys of innovation—each creating solutions tailored to its economic and cultural context. For founders and investors alike, the imperative is to recognize this shift and build accordingly.

Conclusion

The population realignments of the pandemic are not a retreat from innovation—they are a reconfiguration. Just as industrial hubs once spread across the Midwest, and tech clusters rose in California, today’s migration is creating fertile ground for new models of growth.

For those willing to invest boldly and strategically in these emerging geographies, the upside is clear: innovation will not only be more distributed, it will be more inclusive, resilient, and enduring.

We’d love for you to join the conversation:

For Investors:

What products have you seen gain unexpected momentum because of their cultural cachet, maybe even through a surprising media alignment?

For Founders:

Are you building a product with inherent cachet that’s ready to capture the imagination of tastemakers, especially from The Great 38™️? We want to hear from you.

Apply at the link below to learn more about our founder-first approach.

The distributed innovation thesis makes a lot of sense, especially when you consider how infrastructure costs scale differently in secondary markets. The housing & community infrastructure point is interesting - we've been seeing modular construction projects pop up in smaller metros where land and labor are more available. One thing I'm curious about though is whether these regional clusters can actually sustain themselves without the density that traditionally drives serendipitous collabs and talent circulation. Austin and Nashville seem to be managing it, but dunno if thats replicable everywhere.