Q2 2025 Venture Capital Reset

Liquidity, Concentration, and the Rise of America’s Strategic Interior

Executive Overview

The U.S. venture capital market continues to recalibrate after a decade of rapid expansion and the shocks of 2022–2023. The NVCA Q2 2025 report data points to a market in transition rather than contraction: capital is becoming more selective, liquidity mechanisms are broadening beyond IPOs, and geographic imbalances are deepening. For DVRGNT Ventures, these dynamics validate our thesis. While coastal hubs dominate deal value, The Great 38™—America’s strategic interior—remains systematically undercapitalized. At the same time, emerging demand in climate resilience and AI for small and mid-sized businesses (SMBs) is concentrated in these regions, where structural advantages are strongest.

What the Data Reveal

AI Dominates, But Concentration ≠ Innovation

64.1% of all H1 2025 VC dollars went into AI startups. Just five deals exceeded $1B—distorting the entire dataset. This isn’t broad innovation, it’s concentration. For us, that’s arbitrage.

Valuations Rising—But Only for the Prepared

Pre-seed valuations rose 42.3% YoY. Series C valuations jumped 40.5%. The market is rewarding discipline, traction, and execution—validating our focus on operational excellence.

Liquidity Is Evolving: $60B Secondary Market

Secondaries are no longer distressed signals—they’re strategies. We’re embedding secondary optionality into our fund and founder playbooks.

RIA Structures Signal Capital Reorganization

As firms shift to RIA status, venture is moving from rigid theses to modular capital. We’ve already assumed more frequent secondary windows and hybrid liquidity stacking.

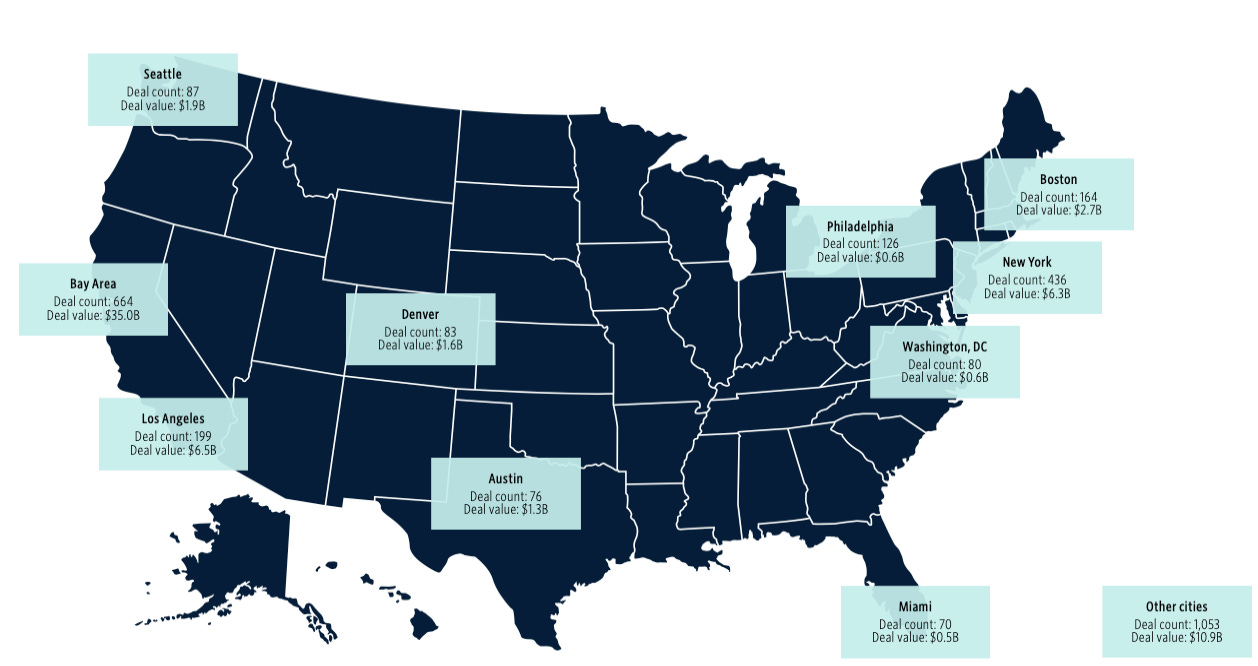

The Coastal Four Absorb 72.3% of VC Value

Bay Area, NYC, LA, Boston pulled 72.3% of deal value but only 48.2% of deal count. That imbalance is the inefficiency DVRGNT was built to solve.

Where Opportunity Lies

Climate Tech and Property Resilience in the New Industrial Core

The South and Midwest are positioned to lead in climate-aligned infrastructure and industrial reinvention. Key opportunity areas include grid-aware energy management, resilient logistics ad supply chains, and property resilience technologies. These are structural, not cyclical, demand drivers.

Applied AI for SMBs

Enterprise adoption of AI is accelerating, but only ~40% of U.S. businesses currently pay for AI tools. The SMB segment—especially across The Great 38™—is vast, underserved, and critical to regional economies. Solutions like Librarian.io illustrate how AI-native onboarding, compliance, and knowledge management can deliver measurable productivity gains at scale.

Implications for Limited Partners

Liquidity is diversifying: direct secondaries are becoming a mainstream option, reducing IPO dependence.

Capital is rewarding discipline: valuations are rising only for companies with traction and execution.

Regional inefficiency is widening: capital allocation remains coastal while innovation is distributed.

DVRGNT Ventures’ Perspective

These dynamics reinforce our model: invest in undercapitalized regions where efficiency is a competitive advantage; embed liquidity planning, including secondary exposure; and back founders solving generational challenges with measurable traction. Venture capital is not collapsing, it is reprioritizing. Durable value will be generated by those allocating into overlooked geographies and applied innovation with structural demand.

For Investors:

What products have you seen gain unexpected momentum because of their cultural cachet, maybe even through a surprising media alignment?

For Founders:

Are you building a product with inherent cachet that’s ready to capture the imagination of tastemakers, especially from the Great 38? We want to hear from you.

Apply at the link below to learn more about our founder-first approach.